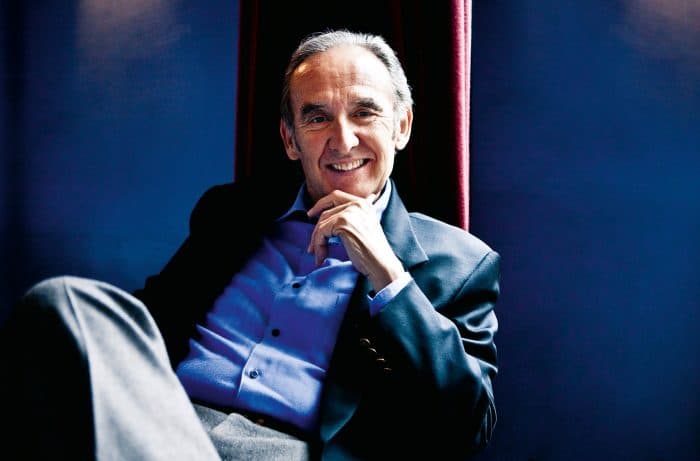

Pedro E. Corona de la Fuente

Partner

Services & Specializations

Admissions

California;

District of Columbia;

Mexico;

US Supreme Court

Languages

Spanish

Address

1901 L Street NW, Suite 620, Washington, DC 20036

525 B Street, Suite 2200, San Diego, CA 92101

Office Tel.

619.515.3272

Fax

619.744.5457

Overview

Pedro is a trusted advisor to global families and privately held multinational companies on a range of investments and operations across borders. His practice bridges international tax, estate planning, and corporate structuring with a deep understanding of the global business and policy environment. He guides high-net-worth families with members of multiple nationalities, family offices, and privately held multinational enterprises in structuring their cross-border investments, optimizing tax efficiency, and preserving multigenerational wealth. He leads Procopio’s International Tax practice.

With extensive experience across the U.S., Mexico, and Latin America, Pedro designs compliant and tax-efficient frameworks for wealth transfer, business succession, and international investment, ensuring alignment with both domestic and foreign legal systems. His work frequently involves advising on treaty interpretation, pre-immigration planning, expatriation, cross-jurisdictional entity governance, reporting obligations, and the tax implications of global mobility.

- Advises clients on tax-efficient structures to implement cross-border mergers, acquisitions and joint ventures.

- Counsels foreign companies and individuals looking to make investments and establish a presence in the U.S.

- Assists U.S. companies and individuals to develop tax-efficient structures for their operations and investments abroad.

- Advises on the acquisition and sale of Latin American companies owned by individuals in the U.S.

- Represents clients in reviewing the potential impact of new U.S. tax laws in their international transactions.

- Counsels foreign individuals planning to move into the U.S. in tax efficient manner, and U.S. individuals looking to renounce their U.S. citizenship.

- Assists multinational families with ties to the U.S. to protect their assets and transfer wealth to future generations in a tax efficient manner.

- Advises on tax implications of loans involving foreign persons and foreign beneficiaries.

- Directs foreign clients to comply with their U.S. estate and gift tax obligations.

- Assists U.S. and foreign clients to comply with their U.S. tax and reporting requirements with respect to their international operations and assets held in other countries.

- Counsels in-house advisors of companies to set up compliance programs for their U.S. tax obligations.

- Represents and advises foreign clients in audits and controversies with the U.S. tax authorities on tax treaty issues.

- Best Lawyers®, Tax Law, 2025-present

- Top 40 Under 40 Professional, San Diego Daily Transcript, 2019

- Latin American Academic Award, International Fiscal Association (IFA), 2013

- MA (International Business and Policy), Georgetown University’s Walsh School of Foreign Service and McDonough School of Business, 2025

- LLM (International Taxation), University of Florida Levin College of Law, 2009

- Certificate in Estate Planning, Georgetown University Law Center, 2023

- Specialization in International Trade Law, Universidad Nacional Autónoma de México, cum laude, 2006

- Diploma in Tax Law, Escuela Libre de Derecho, 2005

- Law Degree, Universidad Autónoma de Baja California – Campus Mexicali, summa cum laude, 2004

- Co-presenter. “Reforma Fiscal en EE.UU. – Guías Recientemente Emitidas por el IRS y el Departamento del Tesoro en Materia de Derecho Fiscal Internacional,” webinar, December 17, 2025.

- Co-presenter. “Reforma Fiscal en EE.UU. – Internacional,” webinar, November 19, 2025.

- Panelist. “Trade: Back to a Trade War After OBBBA?” Procopio International Tax Institute, San Diego, CA, October 31, 2025.

- Panelist. “OECD Update: What is Happening with the Pillars?” Procopio International Tax Institute, San Diego, CA, October 30, 2025.

- Panelist. “OBBBA Unpacked: What’s New in the International Tax Provisions for Individuals and Businesses, Procopio International Tax Institute, San Diego, CA, October 30, 2025.

- Co-presenter. “Reforma Fiscal en EE.UU. – Sociedades y Entidades Fiscales,” webinar, October 22, 2025.

- Co-author. “IRS Intensifies Scrutiny of Puerto Rico Tax Residency Claims Under Act 60,” September 22, 2025.

- Co-presenter. “Reforma Fiscal en EE.UU. y su Impacto en Personas Físicas,” webinar, September 17, 2025.

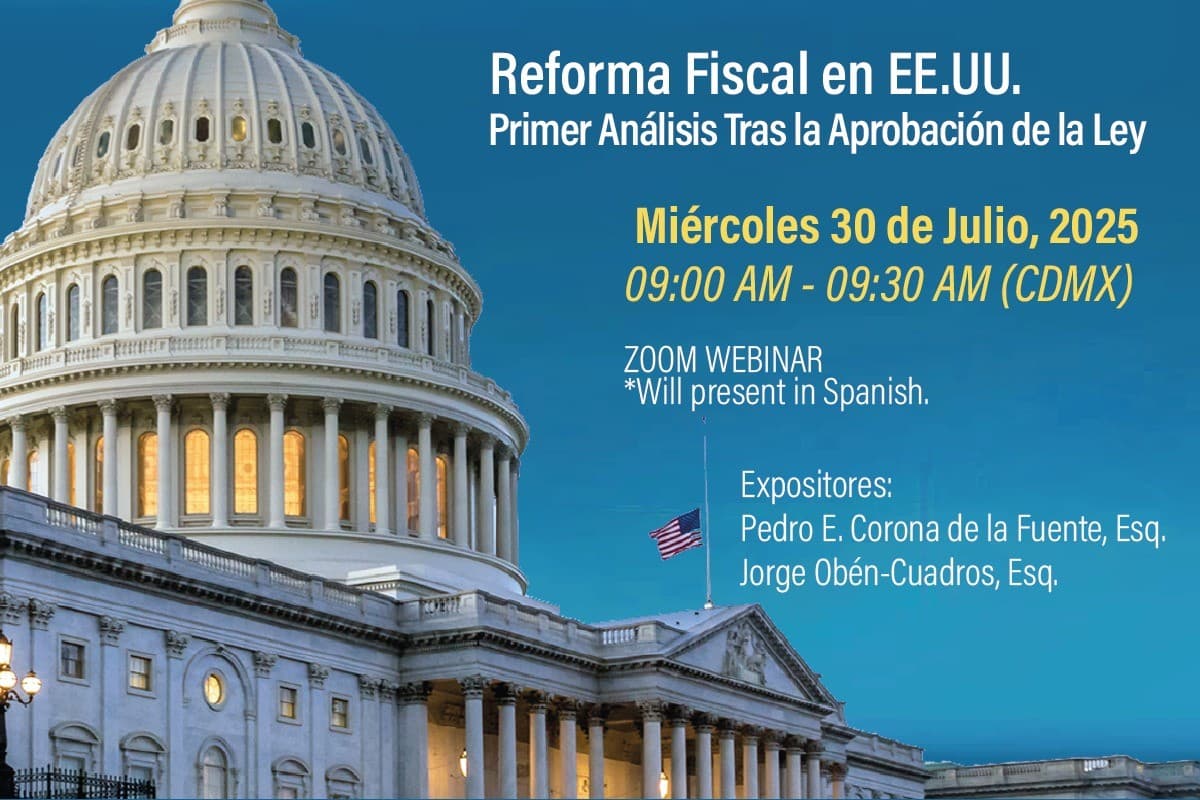

- Co-presenter. “Reforma Fiscal en EE.UU. – Primer Análisis Tras la Aprobación de la Ley,” webinar, July 30, 2025.

- Co-presenter. “Reforma Fiscal en EE.UU. – ¿Qué Está Pasando en Washington D.C.?” webinar, July 1, 2025.

- Co-presenter. “Reforma Fiscal en EE.UU. – ¿Qué Está Pasando en Washington D.C.?” webinar, June 12, 2025.

- Panelist. “Impacto de los cambios en la Era Trump en la Planeación Patrimonial de Familias Mexicanas con Activos o Beneficiarios en EE.UU.,” STEP MEXICO annual seminar, Mexico City, May 29, 2025.

- Speaker. “Reforma fiscal en EUA. – ¿Qué está pasando en Washington, D.C.?” Tax Law Commission of the Illustre y Nacional Colegio de Abogados de Mexico, A.C., Lomas Altas, CDMX, May 28, 2025.

- Panelist. “So Long, Farewell: US Tax Issues for Expatriates,” ABA 2025 May Tax Meeting, Washington, D.C., May 9, 2025.

- Co-presenter. “Reforma Fiscal en EE.UU. – ¿Qué Está Pasando en Washington D.C.?” webinar, April 9, 2025.

- Presenter: “Strategies for Mexican LL.M. students intending to practice U.S. law,” Georgetown University Mexican Law Association, Washington, D.C., April 9, 2025.

- Moderator. “Family Office Issues,” 53rd IFA Conference, Washington, D.C., March 28, 2025.

- Panelist. “Current Penalty Issues,” New York University Advanced International Taxation Conference, New York, NY, July 19, 2024.

- Speaker. “Tributatíon Internacional en el Valle,” Academia de Estudios Fiscales de Baja California, Valle de Guadalupe, Ensenada B.C., Mexico, July 26, 2024.

- Speaker. “U.S.-Mexico Investment Roundtable IV,” La Jolla, CA, July 11, 2024.

- Panelist. “Mexican-United States International Tax Update,” Latin American Family Office Forum by Procopio, San Diego, CA, May 24, 2024.

- Panelist. “Penalties in International Tax Practice – An Update,” USA Branch of the International Fiscal Association Annual Conference, March 21, 2024.

- Co-author. “The IRS Should Clarify the Form 3520 Due Date for Dual Residents,” TaxNotes, August 28, 2023.

- Speaker. “Where in the World…? Recent Updates in International Information Return Caselaw and Practice,” D.C. Bar Association, virtual, January 24, 2024.

- Speaker. “Opening Remarks,” Procopio International Tax Institute, San Diego, CA, May 25, 2023.

- Panelist. “Cross Border Estate Planning for U.S. Beneficiaries with Mexican Assets,” Procopio International Tax Institute, San Diego, CA, May 25, 2023.

- Panelist. “OECD Update,” Procopio International Tax Institute, San Diego, CA, May 25, 2023.

- Co-author. “Deadline Approaching for Some U.S. Companies with Foreign Direct Investment to File with BEA,” April 28, 2023.

- Co-author. “Obligaciones de Reporte Derivadas del Corporate Transparency Act,” Puntos Finos, February 2023.

- Panelist. “Transacting Business in the United States,” Universidad Autónoma de Coahuila, virtual, September 24, 2022.

- Panelist. “Foreign Investment in Mexico,” National Association of Mexican Notaries, August 27, 2022.

- Author. “Introducción a los Impuestos de los Estados Unidos de América,” textbook, Thomson Reuters, 2022.

- Author. “Consideraciones para Mexicanos Invirtiendo en LLCs de los EUA,” June 2021.

- Panelist. “U.S. Individuals Doing Business Abroad: The Flow-Through Toolkit,” IFA USA Southern California Regional Webinar, May 27, 2021.

- Co-author. “Expectativas de Reforma Fiscal en los EUA en 2021,” Puntos Finos, February 2021.

- Co-author. “Proceso para Aprobar una Reforma Fiscal en los EUA,” Puntos Finos, January 2021.

- Co-author. “CODIV-19 y Medidas Fiscales y Económicas de los EUA,” Thomson Reuters Checkpoint, May 2020.

- Panelist. “BEAT & GILTI Guidance: A Leap Forward?” USA Branch of the International Fiscal Association 2020 Annual Conference, Boston, February 27, 2020.

- Panelist. “The GILTI Experience: Lessons for the OECD’s GloBe.” Columbian Tax Institute 2020 Annual Conference, Cartegena, Columbia, February 13, 2020.

- Co-author. “Dolo, Perjurio y Procedimientos de Regularización Fiscal de los EUA,”

- Thomson Reuters Checkpoint, October 2019.

- Co-author. “Nuevos Protocolos de Tratados Fiscales (España, Japón, Luxemburgo y Suiza) / Programas del IRS de Fiscalización Internacional,” Thomson Reuters Checkpoint, September 2019.

- Co-author. “Reglamentos Retroactivos del Tesoro,” Thomson Reuters Checkpoint, August 2019.

- Co-author. “Tasa del 13.125% para Corporaciones de los EUA: Foreign Derived Intangible Income (FDII),” Thomson Reuters Checkpoint, June 2019.

- Panelist. “Global Executives: When is a Permanent Establishment Created, and What’s the Income Attributable to It?,” ABA/IFA Latin American Tax Practice Conference , Miami, June 2019.

- Author. “Forma 3520-A: Informativa para Fideicomisos Extranjeros / Efecto del Cierre del Gobierno de los EUA en Temas Fiscales,” March 2019.

- Co-author. “FATCA y Responsabilidad de Asesores Extranjeros / Adiós al OVDP,” Thomson Reuters Checkpoint, February 2019.

- Speaker. “Family/Succession Planning for Mexican Owned Assets in the U.S.,” International Fiscal Association – Joint Meeting of the US and Mexico Branches, Washington, D.C., February 20, 2019.

- Speaker. “Legal Updates for Mexican Companies Doing Business in the United States,” 18th Annual Mexico Economic Review and Political Outlook 2019, Long Beach, January 25, 2019.

- Co-author. “Caso Altera y Reglamentos Fiscales de los EUA,” Puntos Finos, September 2018.

- Co-author. “Caso South Dakota v. Wayfair y la Clausula de Comercio,” Puntos Finos, August 2018.

- Co-author. “Sección 965: Impuesto sobre Utilidades Retenidas Hasta 2017 / Actualización de Requisitos de KYC,” Puntos Finos, July 2018.

- Co-author. “Obligaciones Fiscales de los EUA para No Residentes y Personas que Viven Fuera de los EUA / FBAR,” Puntos Finos, June 2018.

- Co-author. “Forma 5472 Informativa para LLCs con Socios Mexicanos / Revocación de Pasaportes de los EUA,” Puntos Finos, April 13, 2018.

- Co-author. “Mandatory Deemed Repatriation: Do You Owe Taxes for 2017?” March 26, 2018.

- Speaker. “A Dive into What Do Planners Need to Know When Dealing With our Foreign Neighbors,” California Lawyers Association, The 26th Annual Estate and Gift Tax Conference, San Francisco, March 16, 2018.

- Author. “Nueva Obligacion de Presentar La Forma 5472 Para LLCS Que Tengan Un Solo Socio Extranjer,” 13 de marzo de 2018.

- Co-author. “Post U.S. Tax Reform, What Corporate Structure Is Right for You?” March 8, 2018.

- Speaker. “Global Mobility and Tax Reform in the World Economy,” 46th Annual Conference of the USA Branch of the International Fiscal Association, Houston, TX, February 23, 2018.

- Speaker. “Inbound Tax Planning After the 2017 Tax Act (or What the H Happened?),” American Bar Association, Section Of Taxation, 2018 Midyear Meeting, San Diego, February 9, 2018.

- Author. “Consideraciones de la Reforma Fiscal de los EUA para Inversionistas Extranjeros,” enero de 2018.

- Speaker. “A Dive Into What Planners Need to Know When Dealing With Our Foreign Neighbors,” 2017 Annual Meeting of the California Tax Bar and California Tax Policy Conference, Carlsbad, CA, November 3, 2017.

- Author. “The U.S. Income Tax Treatment of Mexican Retirement Funds Owned by U.S. Persons,” Tax Management Compensation Planning Journal, Bloomberg BNA, November 3, 2017.

- Speaker. “Exchange of Information and Tax Transparency, Including FATCA,” International Fiscal Association – Joint Meeting of the Colombia and USA Branches, Bogota, Colombia, August 25, 2017.

- Speaker. “Tax Aspects of Foreign Investment in U.S. Residential Real Estate,” 2017 Annual Income Tax Seminar, The State Bar of California, Costa Mesa, CA, June 23, 2017.

- Author. “La Residencia Fiscal de las Personas Físicas: Una Perspectiva Latinoamericana,” en Memorias del Premio Latinoamericano de Investigación, Comité Regional Latinoamericano de la International Fiscal Association (IFA), Mayo de 2017.

- Speaker. “International M&A – Purchasing Shares in a Foreign Corporation,” Nuts & Bolts Series, San Diego County Bar Association – International Law Section, San Diego, April 21, 2017.

- Speaker. “Pre-Immigration Tax Planning: Income and Transfer Tax Considerations Before Moving to the U.S.,” STEP Silicon Valley, December 2016.

- “Cross-Border Estate Planning: U.S. and Mexico,” STEP Los Angeles, August 2016.

- Co-author. “The IRS’s Current Offshore Voluntary Disclosure Program: Is This the Only Option Available for An ‘Accidental American?’” International Tax Journal, CCH Wolters Kluwer, January-February 2014.

- Contributing author. “Mexico’s Proposed Tax Reform: International and Cross border Highlights,” October 2013.

- Author. 2013 International Fiscal Association (IFA) Latin American Academic Award. Paper: “La Residencia Fiscal de las Personas Físicas: Una Perspectiva Latinoamericana,” January 2013.

- Author. “Alternativas de Regularización ante el IRS,” IDC Asesor Fiscal, January 2013.

- ‘Mexico.’ The ABA Guide to International Bar Admissions. Eds. Russell W. Dombrow and Nancy A. Matos. CITY: PUBLISHER, 2012.

- Co-author. “U.S. Tax Treaties and Section 6114: Why a Taxpayer’s Failure to ‘Take’ a Treaty Position Does Not Deny Treaty Benefits,” CCH International Tax Journal, May-June 2011.

- Co-author. “Overview of U.S. Interest Income, Exempt from U.S. Income Taxation for the Foreign Investor (‘Portfolio Interest’),” February 2011.

- Author. “Inconstitucionalidad de Cuota Sobre Ingresos Brutos de LLCs en California,” July 2010.

- Co-author. “Proposed Guidance: Why Mexican Retirement Funds Should Not Be Subject to the New Reporting Requirements Under IRC Section 1298(f),” State Bar of California Taxation Section, International Committee, 2010.

Latin America-Focused Seminars

- Speaker. “Reforma Fiscal de los EUA y sus Implicaciones en México”, Ciudad de México, Enero de 2018.

- Speaker. “Planeación Patrimonial en los EUA: Consideraciones Fiscales y Legales”, Colegio de Contadores Públicos de Guadalajara, Guadalajara, México, Noviembre de 2016.

- Speaker. “Alternativas de Inversión en los EUA”, Congreso Regional Fiscal del Instituto del Noroeste de Contadores Públicos, Mexicali, México, Octubre de 2016.

- Speaker. “Consideraciones Prácticas de FATCA: Formas W-8 & Tendencias en Intercambio de Información,” Congreso Internacional del Instituto del Noroeste de Contadores Públicos, Ensenada, México, Septiembre de 2016.

- Speaker. “Acción 3 de BEPS: El Futuro de REFIRPES y las Reglas Subpart F de los EUA”, International Fiscal Association, Ciudad de México, Julio de 2016.

- Speaker. “FATCA y Aspectos Fiscales de Inversiones de los EUA”, Colegio de Notarios del Distrito Federal, Ciudad de México, Febrero de 2016.

Procopio Seminars

- Moderator. “New OECD Guidance Disclosure by Tax Professionals – Exchange of Information and Professional Duties of Confidentiality,” USD Procopio International Tax Institute, November 2, 2018.

- Moderator. “Update on Treaties & the OECD Multilateral Instrument (MLI),” USD Procopio International Tax Institute, November 1, 2018.

- Speaker. “International Planning for Artists and Sportsmen: Tax and Other Legal Considerations,” USD Procopio International Tax Institute, October 27, 2017.

- Speaker. “OECD Multilateral Instrument: A New Approach for Applying Bilateral Tax Treaties,” USD Procopio International Tax Institute, October 27, 2017.

- Speaker. “Cross-Border NAFTA Retirement Plans: Technical Uncertainties and Competent Authority, Federal Social Security taxes while working outside of the home country; Totalization Agreements,” USD Procopio International Tax Institute, October 26, 2017.

- Speaker. “FATCA & CRS: Consideraciones Prácticas,”, USD Procopio International Tax Institute, October 25, 2017.

- Speaker. “Defending and International Tax Case before the IRS and SAT,” USD Procopio International Tax Institute, October 2016.

- Speaker. “OECD Update & New Reporting Requirements in Mexico and the U.S. for International Investments (Refripes & Single-Member LLCs)” USD Procopio International Tax Institute, October 2016.

- Speaker. “Aplicación de Tratados Fiscales Internacionales en los EUA”, USD Procopio International Tax Institute, Octubre de 2016.

- Speaker. “Brazilian Successes in the U.S. – Joga Bonito,” USD Procopio International Business Summit, March 2016.

- Speaker. “MAP’s: When and How to Start a Mutual Agreement Procedure,” USD Procopio International Tax Institute, October 2015.

- Speaker. “Selling Mexican Companies when Involving U.S. Shareholders,” USD Procopio International Tax Institute, October 2014.

- Speaker. “Withholding Taxes on Foreign Persons”, USD Procopio International Tax Institute, October 2014.

- Speaker. “Holding Companies, Treaty Benefits and LOB Clauses,” USD Procopio International Tax Institute, October 2014.

- Speaker. “OECD International Tax Initiatives: BEPS Action Plan and Automatic Exchange of Information,” USD School of Law-Procopio International Tax Institute, October 2013.

- Speaker. “Cross-Border Structures with Hybrid Entities: Avoiding Common Pitfalls,” USD School of Law-Procopio International Tax Institute, October 2013.

- University of Florida, professor in the International Tax LL.M. program

- Mexico Program of the Inter-American Dialogue, Advisory Board Member

- American Bar Association, International and Tax Sections

- International Fiscal Association

- USA Branch: Member of Executive Committee

- Mexican Branch: Past Vice-Chair of YIN Committee

- The State Bar of California

- District of Columbia Bar

- Procopio Elevates Partners,” The Daily Transcript, January 16, 2018.

- “Procopio International Tax Associate Becomes First Mexican to Win Esteemed Latin American Academic Award,” LawExchange International, July 15, 2013.

- “Procopio Associate Receives International Award,” SD Metro Magazine, July 5, 2013.