UPDATE May 13, 2020: With new guidance (FAQ 46) issued this morning, one day before the general safe harbor period expires, the Small Business Administration (SBA) has given many small businesses reason to breathe a bit more freely. The guidance indicates that certifications related to necessity will be deemed to have been made in good faith for all loans less than $2 million. For loans above $2 million, the guidance indicates that necessity certifications will be assessed and if found to “lack an adequate basis,” the loan would be subject to repayment and if repaid the “SBA will not pursue administrative enforcement or referrals to other agencies.”

This appears to free borrowers from potential criminal and False Claims Act liability, at least with respect to statements made regarding the necessity certification. Misleading or false statements made in the applications or regarding other certifications required in the loan application would still be subject to criminal and False Claims Act liability if the money is kept and not returned before the May 14 safe harbor deadline expires. Please feel free to contact us should you have any questions about this fast-changing environment.

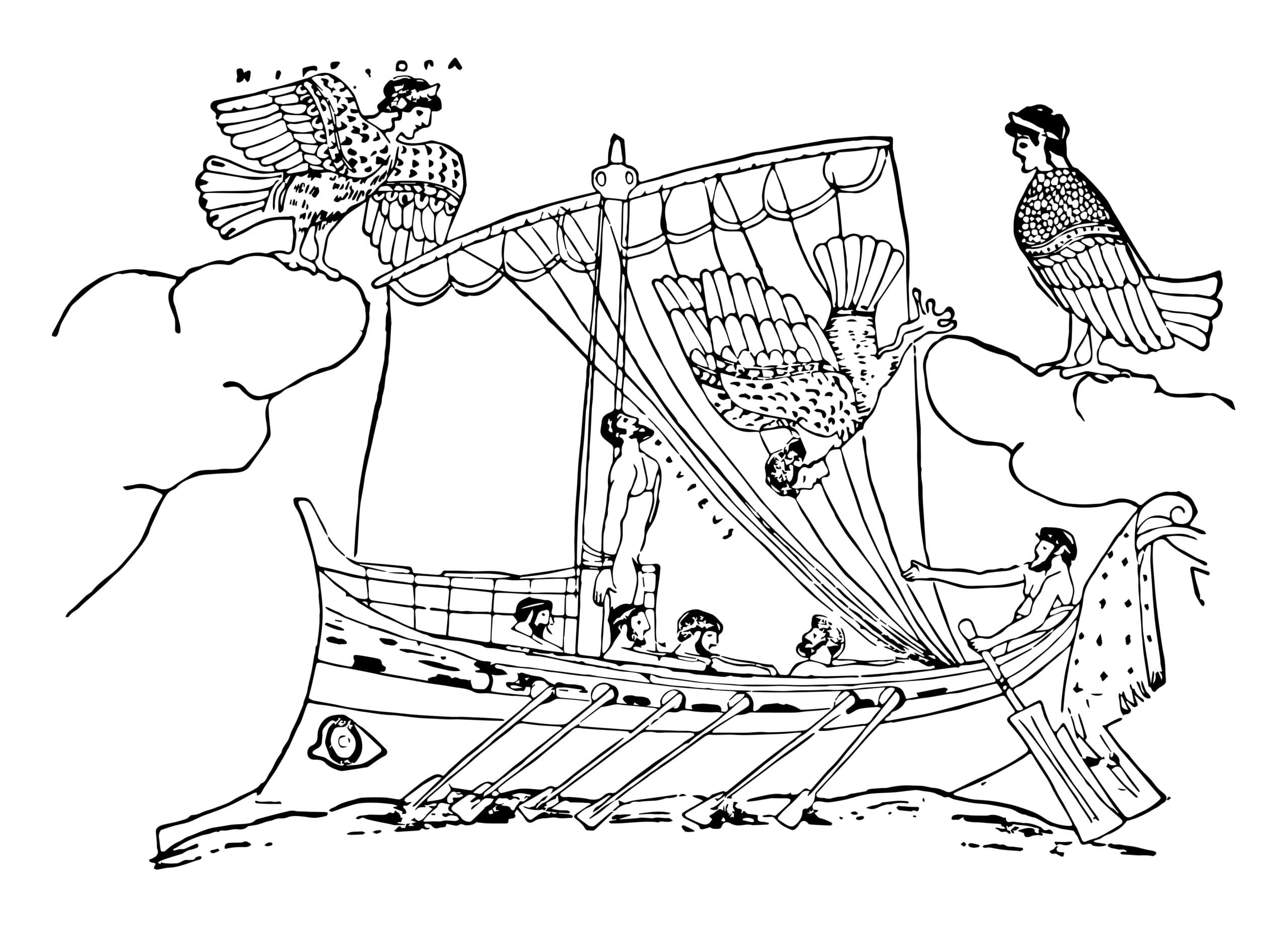

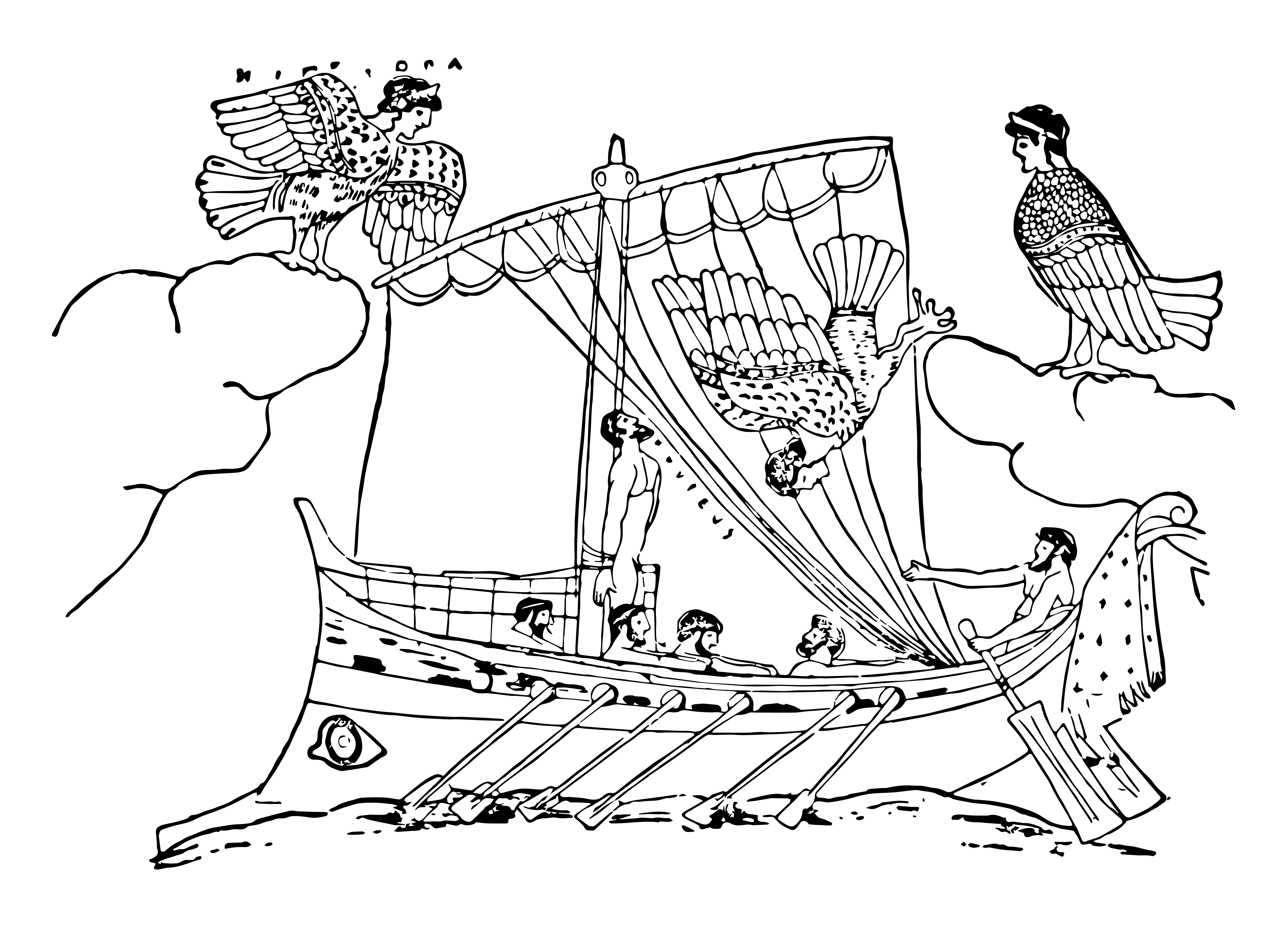

The Paycheck Protection Program, like the enchanting song of the Sirens, has lured small businesses into applying for loans with the promise all will be well. But hidden, like the Sirens’ snares to sink sailors’ ships, are dangers in the form of government regulators and aspiring whistleblowers.

Besides the tight restrictions of how a small business can spend the money and the timeframes within which to spend it, there are other strings attached to the PPP loans, each of which could lead to trouble:

All of these requirements are in place so the government can scrutinize small businesses. To be sure, it is worthwhile to ensure government, i.e., taxpayer, monies are not abused, but the auditors who have been publicly promised to “review” the loans–at least all those loans over $2 million–will not be tasked with determining compliance. Well, they will say that is what they are doing, but in reality their task will be to find discrepancies and each of the hurdles put in place by the government are there to cultivate discrepancies.

All of these requirements are in place so the government can scrutinize small businesses. To be sure, it is worthwhile to ensure government, i.e., taxpayer, monies are not abused, but the auditors who have been publicly promised to “review” the loans–at least all those loans over $2 million–will not be tasked with determining compliance. Well, they will say that is what they are doing, but in reality their task will be to find discrepancies and each of the hurdles put in place by the government are there to cultivate discrepancies.

This typical government approach–to find problems, rather than to assess compliance–will subject small businesses to sanctions, civil enforcement, and possibly even the threat of criminal prosecution. The costs of navigating and potentially resolving such dangers, would likely be more than the value of any relief a PPP loan might temporarily provide.

As you could imagine, the threats could come in the form of bank fraud (18 U.S.C. § 1344), wire fraud (18 U.S.C. § 1343); or alleged false statements (18 U.S.C. § 1001; 15 U.S.C. § 645; 18 U.S.C. § 1014). More troublingly though, are the hazards posed by the False Claims Act (31 U.S.C. §§ 3729 – 3733). While the fraud charges would require proof of an intent to defraud and false statement charges would require knowledge of the falsehood (which are not nearly as difficult to prove as you might think), proofs for establishing a False Claims Act violation are much lower. In fact, the government itself has admitted in guidance put out by the SBA, how low the standard is in such cases.

“[T]here are various civil and administrative remedies that the Government can pursue to address such misrepresentations or false statements even though it is not clear that the misrepresentations or false statements were made knowingly. For example, the Government can bring a claim under the False Claims Act if false statements are made in order to obtain money from the Government with a reckless disregard as to the accuracy of the statements. This has sometimes been equated with a gross negligence standard.”*

This ease of proof, along with the overwhelming penalties and financial incentives in the False Claims Act, make it an attractive weapon for ambitious whistleblowers. Using it as a way to make money, hopeful plaintiffs view the False Claims Act as providing better odds than a lottery ticket but with a comparable payout. Those alleged to have violated the False Claims Act are subject to a loss amount three times the value of any monies they received from the government, before any penalties are imposed. Then a percentage of any sum recovered is paid directly to the whistleblower. The offending company also has to pay the whistleblower’s attorney fees, which is separate from the sum paid to the government.

In the legal world, these make for easy paydays for plaintiffs and their attorneys, so there is significant incentive to pursue these actions. The crux needed to bring such actions is the claim for government money, and the PPP is possibly the largest widespread opportunity for large amounts of government money that this country has ever seen. As a result, ruthless plaintiffs are anxious to benefit from the PPP and cash in their “lottery tickets,” albeit on the backs of small business owners who desperately need the money.

To be blunt, these are the type of realistic threats that keep a small business owner awake at night. And they await any small business that applies for and accepts PPP loan money. Think twice before succumbing to the allure of the PPP’s siren song and call us to help you safely navigate those waters both before and after.

* https://www.sba.gov/sites/default/files/sops/SOP_90_01_5_final.pdf, at pp.8-9.

Patrick Ross, Senior Manager of Marketing & Communications

EmailP: 619.906.5740

Suzie Jayyusi, Senior Marketing Coordinator Events Planner

EmailP: 619.525.3818

Francisco Sanchez Losada, Marketing and Client Relations Manager

EmailP: 619.515.3225

Sanae Trotter, Senior Manager for Client Relations

EmailP: 650.645.9015